Uniswap Protocol: Transforming Decentralized Finance

Introduction

The Uniswap protocol, a symbol of decentralized financial evolution, has drastically altered the way we conceive asset exchange. In this comprehensive article, we will delve into the technical intricacies of Uniswap, breaking down its crucial components, and exploring how its Automated Market Maker (AMM) model has unleashed a disruptive impact on the Decentralized Finance (DeFi) ecosystem.

Technical and Fundamental Components of Uniswap

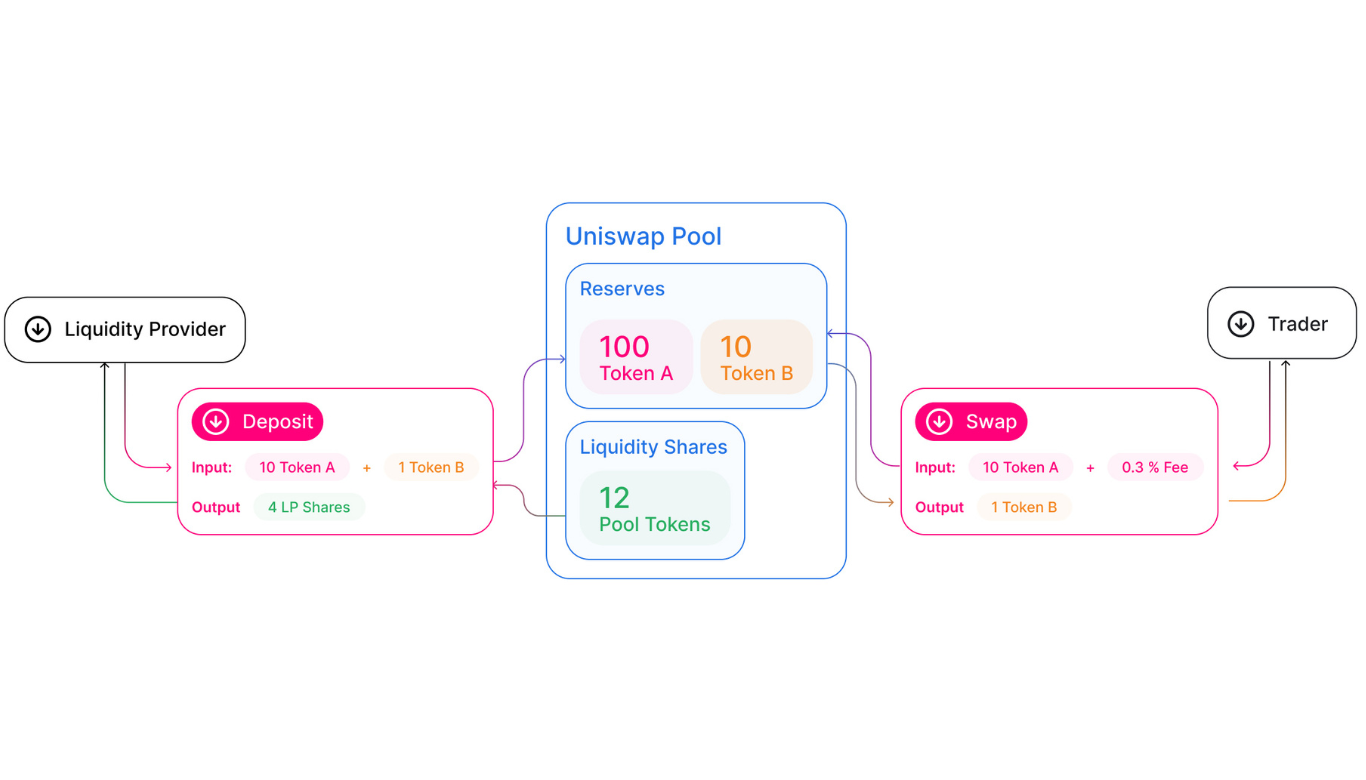

AMM and its Revolutionary Paradigm: At the core of the Uniswap protocol lies its automated market maker approach. Unlike traditional exchange systems, Uniswap relies on smart contracts that enable users to directly participate in price formation and liquidity provision.

The Power of the Constant Product Formula: The seemingly simple equation x * y = k is the key to automation in Uniswap. This formula ensures that as users exchange assets, the product of their quantities remains constant, thus regulating the price.

Delving into Uniswap's AMM Model

Liquidity Contribution and Pool Design: Liquidity providers contribute token pairs to pools. For instance, if Alice contributes 1 ETH and 300 DAI to a pool, this forms the basis for future exchanges.

Exchange Dynamics: When users make exchanges, Uniswap automatically calculates the price based on the x * y = k formula. Token quantities change within the pool to reflect the new price.

Fee Distribution and Benefits: Each exchange incurs a fee, a small fraction of which is distributed to liquidity providers. This model incentivizes continuous liquidity provision while sharing profits with participants.

Disruptive Impact of Uniswap on the DeFi Ecosystem

Catalyst for AMM Creation: Uniswap's innovation has paved the way for a series of subsequent AMM protocols such as SushiSwap and PancakeSwap, multiplying exchange and liquidity opportunities throughout the DeFi ecosystem.

Democratic Access to Liquidity: Uniswap has democratized liquidity provision by allowing individuals and emerging projects to participate in market formation without prohibitive barriers.

Uniswap in Action: A Exemplary Exchange Case

To delve even deeper into the palpable functioning of Uniswap, let's consider a practical case that illustrates the exchange process and the mechanics behind transactions in this protocol.

Let's assume Julia, a cryptocurrency enthusiast, holds 1.5 ETH and is interested in acquiring WBTC tokens. Julia's process can be broken down into several key steps:

1. Exploring Available Pools: Julia accesses the Uniswap platform and observes different available liquidity pools. In this case, she decides to explore the ETH-WBTC pool.

2. Exchange Decision and Liquidity Provision: Julia provides 1.5 ETH to the ETH-WBTC pool to convert them into WBTC tokens. This involves using her wallet and interacting with Uniswap's smart contracts.

3. Exchange Calculation: Once Julia has contributed her liquidity to the pool, Uniswap automatically calculates the amount of WBTC tokens she will receive based on the price determined by the x * y = k formula. This formula ensures that the product of the quantities of the two tokens in the pool remains constant before and after the exchange.

4. Execution of the Exchange: With the calculation done, Julia confirms the exchange. At this point, Uniswap's smart contracts perform the necessary calculations to adjust the ETH and WBTC proportions in the pool and allocate the WBTC tokens to Julia's address.

5. Pool Proportion Change: As a result of the transaction, the ETH-WBTC pool experiences a change in the proportions of ETH and WBTC, thereby affecting the pool's price for future exchanges.

This example exemplifies the intricate operation that Uniswap executes in the background to facilitate efficient and decentralized exchanges. The constant product formula and smart contracts allow each step to be automated, eliminating the need for intermediaries and ensuring that prices reflect real-time supply and demand.

Uniswap: Transformative Force in the DeFi Ecosystem

The presence of Uniswap in the Decentralized Finance (DeFi) ecosystem cannot be underestimated, as its impact extends beyond being a mere exchange protocol. Its introduction has had profound and transformative ramifications in various areas of decentralized finance, granting it a central role in the narrative of financial evolution in the blockchain era.

Democratization of Liquidity and Participation

One of Uniswap's most significant contributions to the DeFi ecosystem is its ability to democratize liquidity provision. Before Uniswap's arrival, participation in market creation and liquidity provision was mainly reserved for institutional actors and large investors. However, Uniswap changed this dynamic by allowing anyone, from individual investors to emerging projects, to participate in market formation and benefit acquisition.

Inspiration for Innovation

The concept of automated markets introduced by Uniswap inspired a wave of innovation in the DeFi space. Several protocols emerged following Uniswap's lead, each with their own variations and enhancements to the automated market maker model. This proliferation of AMM protocols has vastly expanded the options available to users and contributed to the explosive growth of decentralized finance.

Expansion of the DeFi Community

Uniswap has acted as a magnet for the DeFi community, attracting developers, investors, and enthusiasts from around the world. Its focus on decentralization and transparency has set a standard for other projects and contributed to the creation of a global community committed to building a fairer and more accessible financial system.

Bridges Across Chains and Beyond Ethereum

Uniswap's influence is not limited to the Ethereum ecosystem. The concept of automated exchanges has been adopted and adapted in other blockchain networks, demonstrating its ability to transcend the limitations of a single platform. This has paved the way for cross-chain interoperability and the creation of bridges that enable asset transfers and participation in AMMs across different networks.

Challenges and Future Opportunities

While Uniswap has achieved remarkable progress, it also faces challenges in terms of scalability and efficiency on the Ethereum network. Network congestion and high fees can impact the accessibility and utility of the protocol. However, these challenges have also opened the door to exploring layer-two solutions and blockchain alternatives that could further strengthen its position in the DeFi ecosystem.

Conclusion

The Uniswap protocol has not only revolutionized the way asset exchanges are conducted but has also transformed how we conceive the decentralized financial ecosystem as a whole. Its influence has been a catalyst for innovation and the democratization of finance, paving the way for a more inclusive and global financial future. Uniswap, with its engineering approach and vision of a decentralized financial world, continues to be a driving force in shaping a new economic paradigm that benefits all participants.